• Volunteer Income Tax Assistance (VITA)

A Volunteer Income Tax Assistance (VITA) site provides free income tax return preparation to those families who make less than a predetermined amount a year in gross income. This amount is determined based on the Earned Income Tax Credit (EITC) amounts for that year. VITA tax preparers are certified using IRS training materials and serve in a volunteer capacity. VITA sites can be used as tools for delivering tax law changes or partner outreach to the community. In addition, many types of financial education and asset building programs can be instituted into a VITA site as a motivator to the clients to save a portion of their EITC refunds.

• Establishing a VITA Program

Establishing a VITA site begins with partnerships. One partner or several partners work together to form a coalition to deliver the messages and programs that they as a group decide upon. Most coalitions use commitment letters to determine who will take responsibility for different aspects of the program. Committees formed usually consist of a volunteer recruitment committee, training committee, and outreach/marketing committee. A funding committee could also be included.

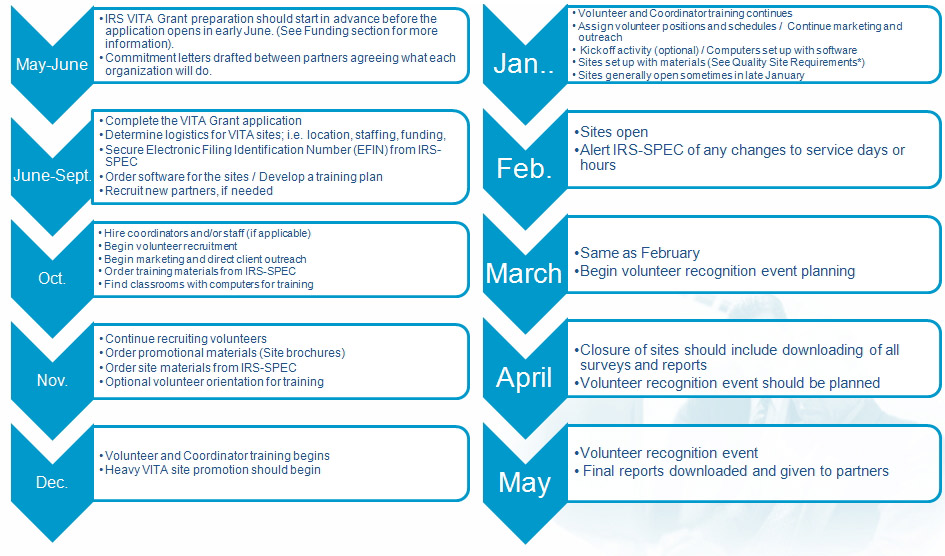

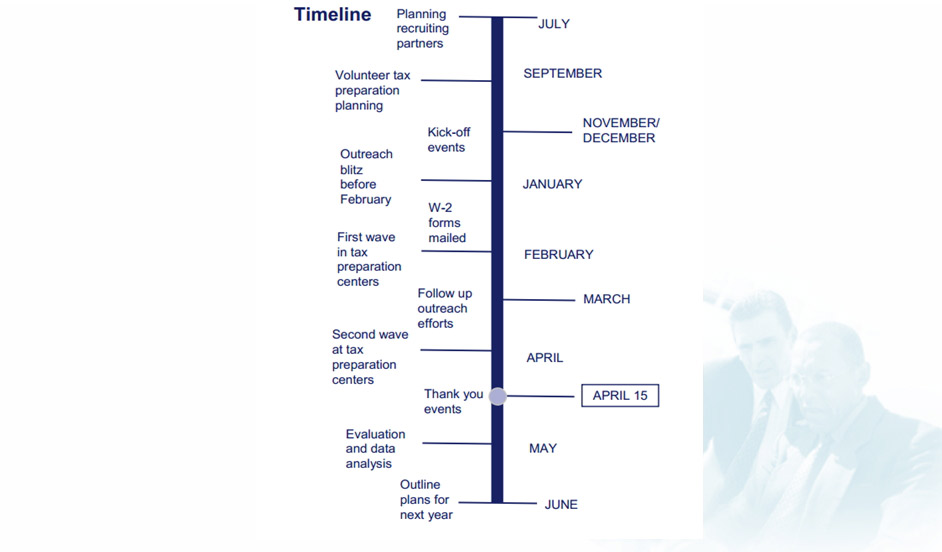

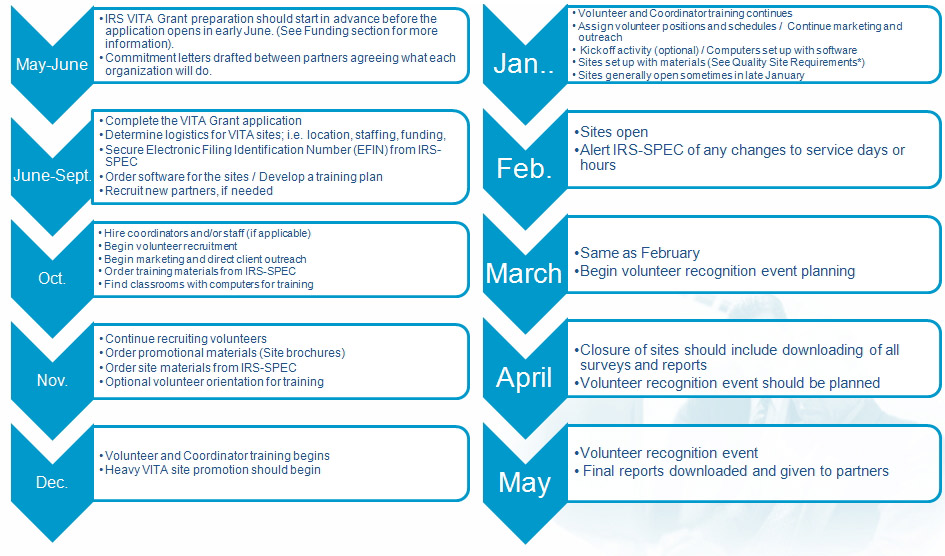

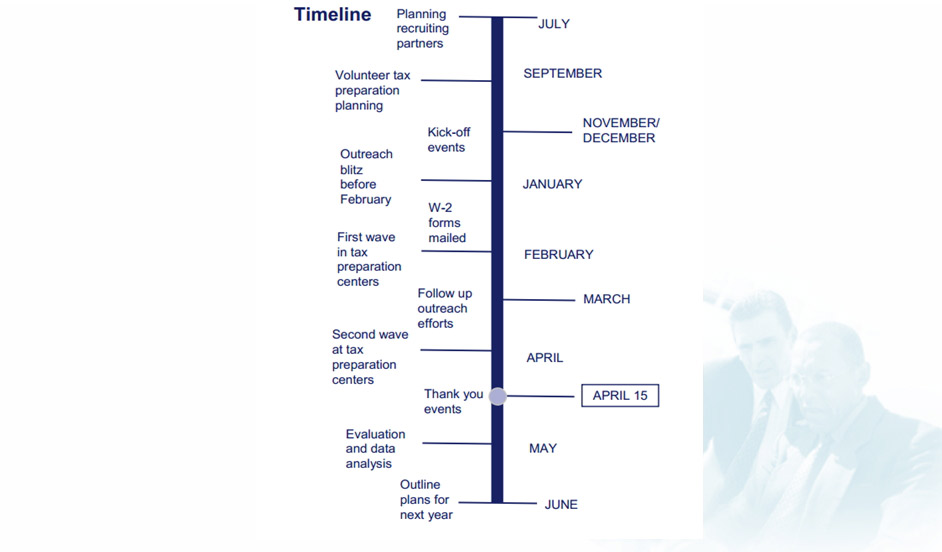

The VITA site opening is established based on the first day of e-filing, generally the second Friday of January. They stay open until the April tax return deadline. However, the successful launch and operation of a VIA site requires planning over a much longer period of time. Participating agencies intending to serve as VITA sites should dedicate some staff time for planning and service delivery year round, with the majority of staff time allocated during September through May.

Running a VITA site includes several phases of activity such as establishing a volunteer recruitment plan, EITC/VITA site promotion, and training of the volunteers. Volunteer recruitment should begin in September and October. If possible, it is helpful to have an existing pool of volunteers from the host agency. Community volunteers already have an established trusting relationship with prospective clients and organizations. Volunteers should be notified that the tax law and software training is usually provided in December and January.

Promotion of the earned income tax credit (EITC) and VITA site outreach is an essential part of the campaign, especially to those who qualify, but do not file taxes because their income is too low. They may still qualify for this valuable credit, but do not know they are available. Outreach is also essential for the many tax law credits that Congress passes each year.

Training of the volunteers in most cases is coordinated between the partners and the SPEC representative. Classrooms need to be located, procedures set in place, computers found and decisions on curriculums made.

• VITA Site Client Flow

VITA sites vary in staffing and facility set-up. In general, when a client arrives at your site, they are met by a Greeter. This Greeter signs the client in and hands them a Form 13614-C, Intake and Interview sheet to complete and then determines if they qualify to receive free tax preparation services based upon their income documents. At some VITA sites, information about other benefits such as savings bonds, checking account or debit card opportunities is also offered to the clients. Other strategies to promote financial stability and independence such as opening bank accounts or schedules of available financial education classes are discussed while clients wait to have their tax returns prepared.

When a Tax Preparer (and Interpreter, if needed) become available, the client meets with the Tax Preparer at their computer work station for in-depth interview using the intake and interview sheet and completion of the tax return together. After the return is prepared, it is quality reviewed by another certified volunteer or a designated Quality Reviewer. The Quality Reviewer follows a checklist to ensure an accurate return. When the tax return is complete, it will be printed so that the client receives a copy and signs the necessary documents. The return is then electronically submitted (e-filed).

• Checklists & Timelines

• Job Descriptions

VITA Site Coordinator

The VITA site coordinator provides coordination, organization, and supervision for all aspects of the VITA site operation. The site coordinator is also responsible for gathering, maintaining and compiling timely statistical reports as required by the partners. A special IRS Site Coordinator training is provided to the coordinators by IRS-SPEC representatives. This course covers all the quality site requirements and other administrative items necessary to effectively operate a VITA site.

Training: Classroom training or self-study through Link and Learn and a passing score of 80% on the exam. Coordinators must be certified through at minimum Intermediate level. If the scope of returns seen at the site is at advanced level, then the coordinator should certify at Advance level.

Tax Preparer

Tax preparers assist low income wage earners in completing their tax returns. Tax

Preparers receive training and are certified by the IRS.

Training: Classroom training or self-study through Link and Learn and a passing score of 80% on the exam. Certification levels are Basic, Intermediate, and Advance. A preparer must take each level of instruction and exam before moving to the next level. A preparer can only prepare returns that are within the scope of the level of certification he/she has. For example, a taxpayer who has itemized deductions needs to have the return prepared by a preparer with an Intermediate or above certification.

Quality Reviewers

Quality Reviewers follow a check list found on the Form 13614-C, Intake and

Interview Sheet, along with the taxpayer’s return file to review tax returns after the return is prepared to ensure accuracy. Some VITA sites train all their volunteers on quality review depending on the size of the volunteer preparer cadre.

Training: Classroom training or self-study through Link and Learn and a passing score of 80% on the exam. Reviewers must certify, at a minimum, through Intermediate level. Additional quality reviewer training is required.

Transmitters (Electronic Return Originators, ERO)

Transmitters or ERO submit tax returns electronically to the IRS from VITA sites. Volunteers should be familiar with complex software, electronic data transmission and tax law. Transmitters help troubleshoot tax returns that are rejected by the IRS. Transmitting is often done by the site coordinator.

Training: Classroom training or self-study through Link and Learn and a passing score of 80% on the exam. Transmitters should certify, at a minimum, to an Intermediate level. Additional transmitter training is required.

Interpreter

Interpreters aid VITA clients by working alongside the tax clients and tax preparers. Interpreters are always an asset to a site.

Training: No training required.

Greeters

Greeters welcome tax filers to the VITA site during the tax season. They are responsible for ensuring that tax filers have all the information needed to complete their tax returns, including the intake-interview form and all income documents.

Training: No training required, but some partners often provide a separate greeter training.

Asset Development Specialist

This specialist connects clients to services and public benefits for

which they may qualify, including food stamps, children’s health insurance, asset-building products and services, U.S. Savings Bonds and other banking products.

Training: No tax law training required, but VITA coalition partners generally provide additional training that relates to the products.